SEARCH FOR PROPERTIES NOW...

Student

Professional

Leeds’ £14.51 Billion Inheritance from Baby Boomers Won't Save Gen X and Millennials

Many Leeds people I talk to in their late 30s to late 40s are relying on the inheritance from their baby boomer generation parents to help them in their home buying and retirement future.

It is true there is £2 trillion (£2,040,861,524,790 to be exact give or take a few pennies) tied up in equity in the property of everyone in the UK who is aged 65 years and older (to add context to that the NHS costs £181 billion per year, well under a tenth of the equity tied up in property).

With additional investments in stocks and shares including buy-to-let properties of around £2 trillion to £3 trillion, it is estimated there is a total of between £4 trillion and £5 trillion that will be inherited in the next two decades from Baby Boomers (born between 1946 and 1964) to both Generation X (born 1965 to 1980) and in some part Millennials (born 1981 to 2000).

This financial realignment, already in motion, is expected to unfold over the next few decades, reshaping the economic landscape for many and offering a glimmer of hope to younger generations facing many financial uncertainties.

The narrative surrounding this monumental transfer of wealth has captured the media's attention, not only due to the staggering magnitude of the figures involved but also because of the potential implications for the financial well-being of younger generations.

Many Leeds Generation X and Millennials have navigated a turbulent economic landscape marred by skyrocketing student loan debt, escalating living expenses and a series of economic downturns, including the Global Financial Crash.

These challenges have cast a shadow of financial insecurity over this group of people, leaving many to question their prospects for achieving a stable and secure retirement.

So how much equity is tied up in homes locally? Looking at numbers for our Local Authority.

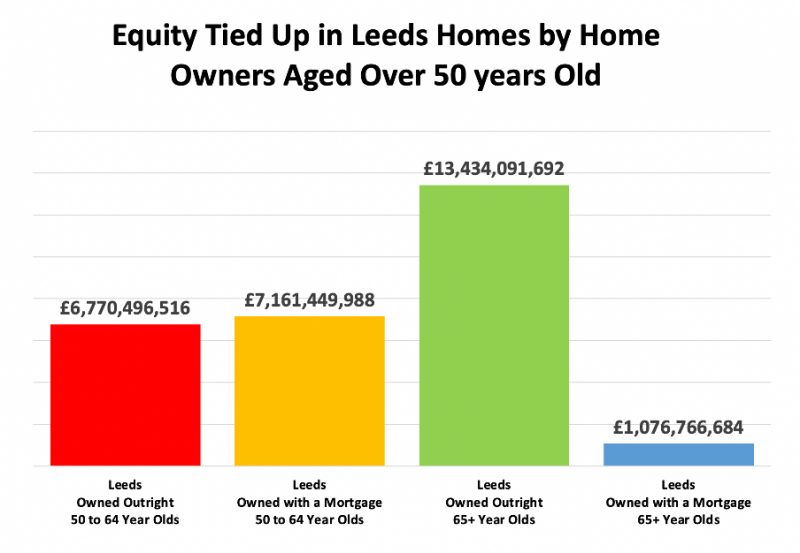

Leeds Baby Boomers own 57,179 homes outright, worth £13,434,091,692 with a further 4,583 homes with a small mortgage on it, worth an additional £1,076,766,684 (an impressive £14.51 billion in Leeds alone).

Despite the allure of this impending wealth transfer, the reality is more nuanced and complex.

A considerable portion of this equity is poised to circulate within already well-off property-owning families. This stark reality serves as a sobering reminder of the wealth disparity that characterises the current economic landscape, tempering expectations of a widespread windfall.

Adding another layer of complexity to this scenario is the looming spectre of healthcare costs for the ageing Baby Boomer population. According to Age UK, on average, it costs around £800 a week for a place in a care home and £1,078 a week for a place in a nursing home. The exorbitant expenses associated with elderly care, including long-term care facilities and home health aides, pose a significant threat to depleting the savings (and equity) of many Baby Boomers, potentially leaving little to be passed on to their heirs.

This predicament underscores the precariousness of relying on inheritance as a financial safety net.

The Leeds Baby Boomer generation, having reaped the benefits of significant economic growth and wealth accumulation opportunities, particularly in their property and stock market investments, now faces the daunting challenge of ensuring financial resilience in the face of escalating care home and healthcare costs. The dream of bequeathing a substantial inheritance to the next generations may be at risk, as the financial burdens of healthcare threaten to consume a significant portion of their accumulated wealth.

As the nation grapples with an aging demographic and the accompanying financial challenges, the narrative surrounding this wealth transfer necessitates a closer examination, calling for a more nuanced understanding of the interplay between wealth, healthcare and intergenerational equity.

Moreover, younger generations' reliance on inheritance as a means of financial security highlights a deeper systemic issue within the economy.

The challenges Leeds Gen X and Millennials face, from the burden of student loans to the volatility of the job market, underscore the need for structural reforms that empower individuals to build financial stability independent of familial wealth.

My final thoughts on this are that while a generational wealth transfer narrative offers a compelling vision of financial redemption for Leeds’ younger generations, the reality is fraught with complexities and challenges. Wealth inequality, rising care home costs and systemic economic barriers necessitate a comprehensive and multifaceted approach to fostering financial security and equity across generations. Every generation needs to take its own personal responsibility regarding their existing housing and living needs and their future retirement needs.

As we navigate this pivotal moment in our country’s history, we must engage in thoughtful dialogue and policy-making that address these critical issues, ensuring a more prosperous and equitable future for all.

P.S. Not all is lost for you older Millennials or Generation Y-ers (those born after 2000), as you will inherit an additional £3.4 trillion in equity owned by the Gen X-ers. Yet how much locally?

Leeds Gen X-ers own 28,817 homes outright, worth £6,770,496,516 with a further 30,481 homes with a mortgage on it, worth £7,161,449,988 (an equally impressive £13.93 billion in Leeds alone).

Back to news